Smart Financial Strategies for Unexpected Events

A once-in-a-lifetime event such as the coronavirus pandemic forces us to reassess many things we may have taken for granted. Most of us take our personal good health for granted. Many of us assume we will always get by financially, that we will always be able to earn money in some way, and that, in a worst-case-scenario, the government will be there to step in and help.

But assumptions are always there to be challenged. And adverse situations always should teach us some lessons. What lessons can we take away from the current crisis that will help us better prepare for an event that appears suddenly and upends many of our day-to-day activities? Specifically, what steps should we take to ensure that we will have enough money set aside to see us through another crisis? What can we do going forward so that we will be able to pay our bills and handle unforeseen expenses if we lose our jobs? Why is it a good idea to limit our debt burden, and how can we achieve this goal?

Here are some ideas that could jump-start your thinking.

Spend Less Than You Earn

It’s easier said than done. But it is one of the most effective ways of building up your savings and your personal wealth. You may have to reevaluate what you consider important — especially if shopping has always been enjoyable for you. You can still shop, just not as often and only for items that you or your family members truly need.

Set yourself a goal of setting a percentage of your pay aside for savings. If need be, start small so you don’t get discouraged. Then, increase the percentage you save after a few months.

Look for Ways to Boost Savings

Now that you have decided to spend less than you earn, you can start to look seriously at ways to increase your savings. For example, you may be able to find some extra cash by shopping around for better rates on your utilities, cell phone service, and auto or home insurance. If your credit score is good, you may be able to find a credit card with a lower interest rate than you currently pay. And, if you can afford the closing costs, refinancing your mortgage could potentially unlock some solid savings.

If you do not have a budget, now is the time to create one. A budget can help most people organize and control their spending. If you track your spending for a few months, you can use that information to cut back on impulse buying and spending on nonessential items and redirect that money to savings and investments.

Be sure to direct some of that money to your own emergency fund. An emergency fund should be used to pay for unexpected, large expenses so you don’t have to borrow the money. Financial experts say that, ideally, your emergency fund should be able to cover six months of living expenses — including mortgage and auto payments. It sounds like a lot to save, but you may be surprised how much you can save when you focus on that goal.

Take Control of Your Debt

Debt is like savings in reverse. When you are in debt, you keep paying interest on goods and services that you probably consumed two or three years ago. If you carry consumer debt, now is the time to get a handle on that situation. You are not in a good place if:

- Your credit card balance is growing

- You are paying only a minimum on your bills

- You are missing payments or paying late.

For every loan and credit card you carry, find out how much you owe, the interest rate, and the payment schedule. You can use this information to figure how much money you can afford to put toward paying down your debt and how long it will take. These strategies can help:

- Pay off the card with the highest interest rate first;

- Transfer your balance to a card with a lower interest rate; and/or

- Pay more than the minimum amount. Paying more than the minimum is critically important since the less you pay, the greater the interest will be and the longer it will take to pay off your balance.

Every few months, check your expenses to see if you can find other funds to use to reduce your debt. If possible, consider part-time work and use what you earn to pay off your debts. In the meantime, do not take on additional debt. Try using cash (or your debit card) instead of credit for as many transactions as possible.

Protect Your Earning Power

If you are a working parent, your family’s financial well-being is tied closely to your ability to make a living. If you were to have an accident or fall ill, your disability could destabilize your finances. If you do not have a private disability income insurance policy, consider getting one. The payments from the policy would help pay for critical everyday expenses when your disability prevents you from working and collecting a salary. Before you purchase insurance, though, make sure you understand the policy’s definition of disability and all the other policy terms.

You also may want to name someone you trust to make financial and health care decisions if you become unable to make them for yourself. Talk to your attorney to learn more about the options available in your state. And you might consider setting up a living trust that allows the trustee of the trust to handle your financial affairs if you cannot.

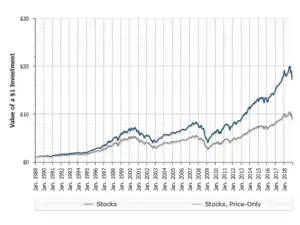

Review Your Investing Strategy

Finally, remember that risk is a given in investing. Some investments carry a higher risk of loss than others. However, riskier investments typically offer higher potential returns than more conservative alternatives. When you invest you have to decide how much investment risk you can comfortably handle while seeking higher returns, and choose your investments accordingly. It helps to review your investing approach and your tolerance for possible investment losses at least once a year.

Facing the Future

Every crisis is different. However, those who think ahead and have some strategies in place to deal with the financial aspects of a crisis are potentially more likely to do better than those who do not plan.

This material was prepared by LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

The cost and availability of Life Insurance depend on many factors such as age, health, and amount of insurance purchased. In addition to premiums, there are contract limitations, fees, exclusions, reductions of benefits, and charges associated with policy. And if a policy is surrendered prematurely, there may be surrender charges and income tax implications. Any guarantees are contingent upon the claims-paying ability of the issuing company.