Deciding When to Start Taking a Pension

Deciding When to Start Taking a Pension

Most businesses today do not offer a pension plan. But pensions are still a common benefit for teachers, federal employees, and others who work in the public sector. Many grandfathered private-sector plans also still exist. In fact, according to the Bureau of Labor Statistics, over 30 million public and private sector American workers participate in a pension plan.1

For those fortunate enough to have a workplace pension, one of the critical decisions you’ll need to make is when to begin collecting. Although payments typically begin at age 65, many plans allow you to start collecting your retirement benefits as early as age 55. But if you decide to start receiving benefits before you reach full retirement age, the size of your monthly payout will be less than it would have been if you’d waited. So the question is: when is the optimal time to start, so that you maximize your total payments?

Unfortunately, there is no simple answer. What works best for you will depend upon a number of different factors. Here are some points you’ll want to consider before deciding.

Longevity. The longer you live, the better off you will be by delaying your pension payments. Although nobody can pinpoint exactly how long they will survive, they may be able to make a guesstimate. Today’s newborns have an average life expectancy of close to 79 years. A man who reaches age 65 has a life expectancy of about 83; a woman, about 86. Those in good health with a family history of longevity stand a good chance of exceeding these figures. What’s more, medical advances have helped increase these averages over time. As a result, many people today can look forward to retirements of 30 years or longer.

Specific terms of the pension plan. The terms of a pension vary widely from plan to plan. A typical pension plan’s payout depends on years of service. So your timing may depend on when you hit a threshold year. Other factors affect payout, such as whether overtime and bonuses count toward your payout or if benefits are capped at a certain percentage of salary. Many plans also offer cost-of-living adjustments (COLAs). So make sure to check the terms of your specific plan.

Is the pension safe? Although there are federal and state laws that seek to ensure that a given pension plan meets all its payment obligations, there is no guarantee that that will be the case. Pension plan defaults have been rare, but no pension plan is bulletproof. If a local government entity or private corporation falls on hard times, it could affect pension payouts. It’s no secret that many large public plans are underfunded. Some estimates put the collective shortfall in the trillions. Whether such underfunding will eventually reduce benefits in a particular plan is anyone’s guess. But the upshot for prospective pensioners is that it may not be wise to pin all your retirement hopes on one pension plan.

Personal circumstances. Everyone has individual needs and financial situations. You may have other sources of retirement income — Social Security, an individual retirement account (IRA), a 401(k) plan, or other retirement savings. You may also plan to cash in on a home or other real estate to help fund your retirement. Or, you may have a spouse with his or her own pension plan. Whatever your circumstances, be sure to factor them into your decision.

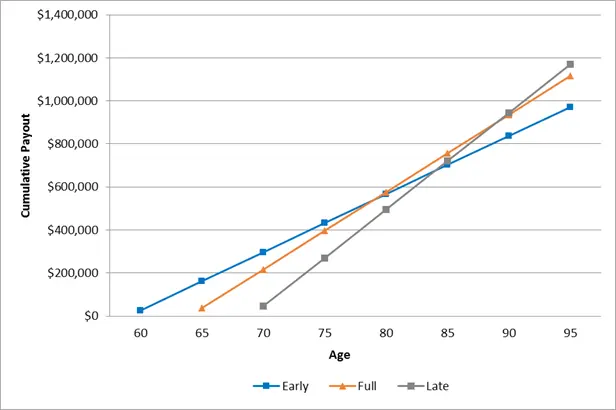

Compare Cumulative Payouts2

The following chart shows the cumulative payments of a hypothetical pension plan, for early (age 60), full (age 65), and late (age 70) start times. It assumes a pension of $3,000 per month or $36,000 per year at full retirement age; that payments are fixed, with no COLA increases; and that the pension decreases 5% for each year of early retirement and increases 5% for each year of late retirement (until age 70).

Note where the lines cross each other. An early start will result in the highest cumulative benefit until you hit age 80. After that point, “full” timing begins to net a higher cumulative payout. And if you opt to wait until age 70, your cumulative benefit won’t outpace a full benefit until you reach age 90.

Keep in mind that this example is for illustration purposes and may differ from your actual experience. Talk with a financial advisor who can help you decide when is the best time to start taking your pension payouts.

Notes

1Bureau of Labor Statistics, National Compensation Survey for 2018.

2Illustration is hypothetical. Your plan will differ.

Leave a Reply

Want to join the discussion?Feel free to contribute!