Converting a Traditional IRA to a Roth IRA

Thinking of Converting Your Traditional IRA to a Roth? Now May Be the Time

Anyone who is thinking of converting a traditional IRA to a Roth IRA may want to consider do it this year. Why? Because today’s unique conditions create an opportunity to minimize the tax bite from converting. In fact, many have already taken advantage of this opportunity, with one provider reporting a 67% increase during the first four months of 2020 compared to a year earlier.1

But before you begin to decide whether or not to convert, make sure you are familiar with what’s involved with a Roth conversion.

What’s a Roth Conversion?

When you convert your traditional IRA to a Roth IRA, any deductible contributions you had made, along with any investment earnings, are taxed as ordinary income for the year of the conversion. That means the taxable value of the conversion could push you into higher federal and state tax brackets.

You will be responsible for full payment of all taxes in the year the conversion is made. If you use assets from the traditional IRA to pay those taxes, the tax amounts could be treated as premature withdrawals, so you could be subject to additional taxes and penalties.

Depending upon your personal financial situation, a Roth IRA conversion could potentially provide a tax-adjusted benefit over time, provided you meet the eligibility requirements.

Why Now?

The coronavirus pandemic has created unique conditions that may make a Roth conversion more attractive than usual.

Your taxable income may be lower

If, like millions of Americans, you have been furloughed or laid off, or your sales commissions are down, you will likely report lower taxable income for 2020. This may put you in a lower tax bracket so that monies converted to a Roth would be taxed at a lower rate than would otherwise apply (unless the amount converted pushes you into a higher bracket). For instance, converting a $15,000 IRA when your marginal federal tax rate is 12% saves $1,500 of tax compared to converting at a 22% marginal rate — and that does not include state tax, which might also drop.2

Your business may incur a loss

The pandemic is causing many businesses to close or incur a loss. If you expect to report a business loss on your personal return, you may be able to convert to a Roth at a reduced tax cost. With the Roth conversion creating additional income, you could use the loss generated by the business to offset some or all of that income.

Your IRA balance may be down

To minimize taxes, it’s better to convert assets when they’re low in value. Although U.S. stocks have recovered most of the ground lost in February and March, it’s possible your IRA balance may still be well off its peak, depending on how it is invested.

RMDs are suspended for 2020

As part of the CARES Act, required minimum distributions (RMDs) for traditional IRAs and qualified retirement plans were suspended for this year. Not taking distributions from a traditional IRA might keep or put you in a lower tax bracket by reducing your taxable income, making it even more desirable to convert to a Roth.

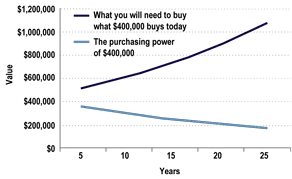

Current tax rates are low and could go up

The 2017 Tax Cuts and Jobs Act (TCJA) reduced federal tax rates, cutting the top marginal rate to 37%. That’s relatively low compared with recent history. Given the staggering price tag of the pandemic bailout (so far) and the ballooning budget deficit, it’s reasonable to assume that at some point, tax rates may increase. When this might happen is anyone’s guess, but converting while rates are relatively low is something to consider.

To Convert or Not?

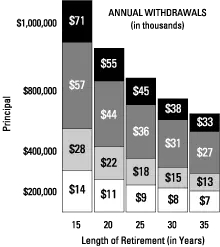

Whether you would be better off leaving your funds in a traditional account or moving all or some of them to a Roth IRA will depend upon your personal circumstances. Generally speaking, Roth IRA conversions are best suited for investors who have significant time until retirement, are high wage earners, think they may be in a higher tax bracket at retirement, or are looking for an estate planning tool to help pass wealth to their heirs.

Whatever your circumstances, keep in mind that IRS rules governing IRAs and conversions are complex. So be sure to consult with a financial or tax professional before deciding.

Source/Disclaimer:

1Money, Roth IRA Conversions Are Surging. Here’s Why This Retirement Savings Strategy Is So Popular Right Now, June 4, 2020.

2Example is for illustration only. Your results will differ.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year your convert, you must do so before converting to a Roth IRA.

This material was prepared by LPL Financial. This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that they views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change. All performance referenced is historical and is no guarantee of future results.